What Is Opportunity Cost?

Opportunity costs represent the benefits an individual, investor or business misses out on when choosing one alternative over another. While financial reports do not show opportunity cost, business owners can use it to make educated decisions when they have multiple options before them. Bottlenecks are often a cause of opportunity costs.

Because by definition they are unseen, opportunity costs can be easily overlooked if one is not careful. Understanding the potential missed opportunities foregone by choosing one investment over another allows for better decision-making.

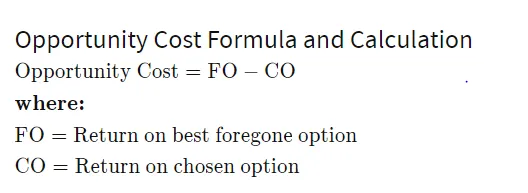

Opportunity Cost Formula and Calculation

The formula for calculating an opportunity cost is simply the difference between the expected returns of each option. Say that you have option A, to invest in the stock market hoping to generate capital gain returns. Option B is to reinvest your money back into the business, expecting that newer equipment will increase production efficiency, leading to lower operational expenses and a higher profit margin.

Opportunity Cost and Capital Structure

· Opportunity cost analysis also plays a crucial role in determining a business’s capital structure. While both debt and equity require expense to compensate lenders and shareholders for the risk of investment, each also carries an opportunity cost. Funds used to make payments on loans, for example, are not being invested in stocks or bonds, which offer the potential for investment income. The company must decide if the expansion made by the leveraging power of debt will generate greater profits than it could make through investments.

· Because opportunity cost is a forward-looking calculation, the actual rate of return for both options is unknown. Assume the company in the above example foregoes new equipment and invests in the stock market instead. If the selected securities decrease in value, the company could end up losing money rather than enjoying the expected 12 percent return.

· For the sake of simplicity, assume the investment yields a return of 0%, meaning the company gets out exactly what it put in. The opportunity cost of choosing this option is 10% – 0%, or 10%. It is equally possible that, had the company chosen new equipment, there would be no effect on production efficiency, and profits would remain stable. The opportunity cost of choosing this option is then 12% rather than the expected 2%.

· It is important to compare investment options that have a similar risk. Comparing a Treasury bill, which is virtually risk-free, to investment in a highly volatile stock can cause a misleading calculation. Both options may have expected returns of 5%, but the U.S. Government backs the rate of return of the T-bill, while there is no such guarantee in the stock market. While the opportunity cost of either option is 0 percent, the T-bill is the safer bet when you consider the relative risk of each investment.

Comments are closed.