There is an extensive literature studying the growth and employment dynamics of US firms over their life-cycle (for one of the early papers on the topic, see Davis et al. 1996). Far less is known about how these firms finance their growth. Much of what is known about firms’ financing behaviour derives from publicly listed, relatively large and old firms in Standard & Poor’s Compustat. Yet, the behaviour of private firms, which are much younger and smaller on average, has important macroeconomic implications since these firms account over 70% of aggregate US employment and over 55% of aggregate US gross output, and they are the ones that are most susceptible to the effects of financial shocks that impede lending and borrowing.

In a recent paper, we construct a new dataset to better understand how firms at different points in their life-cycle choose to (or are able to) finance their operations and the implications of this life-cycle financing on firm growth and responsiveness to aggregate shocks (Dinlersoz et al. 2018). We use balance sheets of both publicly traded and privately held firms matched to the US Census Bureau’s Longitudinal Business Database (LBD). We refer to our new dataset as LOCUS, as it combines the LBD (“L”) with balance sheet data of privately held firms from Bureau van Dijk’s Orbis (“O”) and publicly listed firms from Compustat (“C”) for the US (“US”). This new dataset allows us to compare the relatively understudied behaviour of leverage for private firms with that of the large listed firms, which has been the main focus of the existing literature. We explore leverage both in cross-section and over time for a given firm as a function of the lifecycle dynamics of firms, proxied by their age and size. Then, we focus on the implications of firms’ financing and leverage on their growth and their response to shocks, particularly to the financial crisis of 2007-2008.

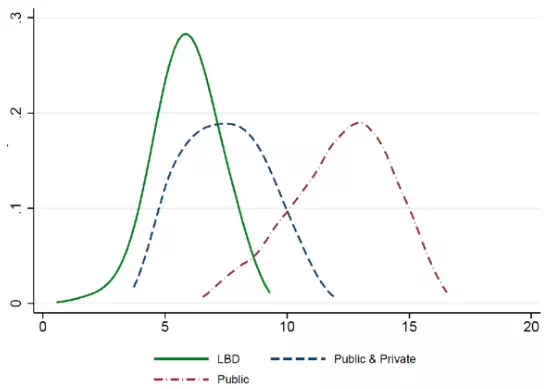

Figure 1 Revenue distributions for different datasets

Figure 1 shows firm revenue distributions for different datasets. Our new dataset (blue line), which covers more small firms, is closer to the coverage of the LBD data from census (green line), which contains the universe of all US employer businesses. The difference of course is that we have the balance sheet information for the firms whose revenue distribution is represented by the blue line, whereas we do not have this information in the census data. The red line represents publicly listed firms, where we also have the financial information, however, as can be seen, these firms are very large and not representative of the US economy. The figure shows the raw data, which might suffer from selection due to voluntary reporting of financial data by private firms in the US. We correct for this selection by using the propensity weights that we created by matching private firms who report financials to the universe of private employer businesses in the LBD. We perform our regression analysis with the re-weighted data.

Our results show substantial heterogeneity in leverage by firm age and size among private firms, but not among public firms. In the cross-section of private firms, larger firms are more leveraged and they have less equity as a fraction of their assets. Over time, as private firms get older, their leverage decreases and their equity increases. Small private firms are the least leveraged but young private firms are the most leveraged, indicating that size and age have different relationships with leverage for private firms. For public firms, the relationship between leverage and size is weak and slightly negative. The equity–size relationship has an inverted U-shape for public firms. Since these firms have access to external equity via stock issuances, they issue less external equity and turn toward long-term debt borrowing as they become larger. Compared to private firms, the relationship between age and leverage is far weaker among publicly listed firms.

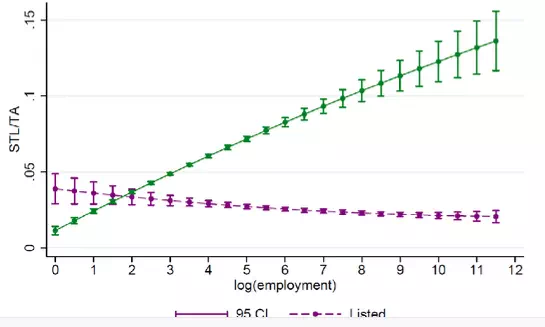

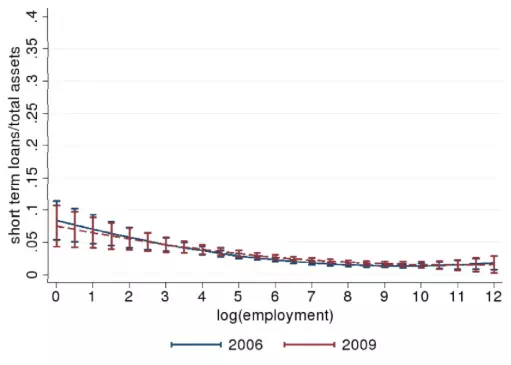

Figure 2 Short-term loans/total assets (quadratic in log employment)

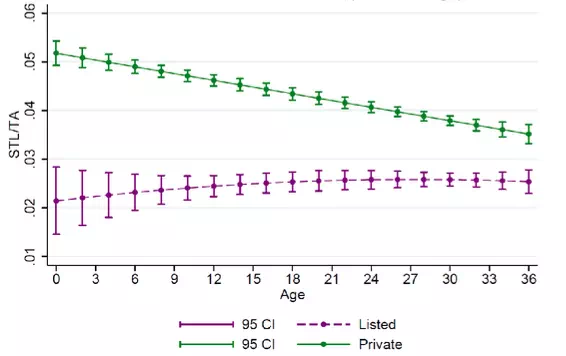

Figure 2 shows the strong non-linear relationship for private firms between short-term debt-based leverage and firm size, whereas there is no such relationship for public firms. Figure 3 similarly shows that the relationship between age and leverage is drastically different between public and private firms.

Figure 3 Short-term loans/total assets (quadratic in age)

The firm dynamics literature has established that, conditional on age, firm growth is negatively related to the size of the firm. It is also the case that conditional on size, firm growth is negatively related to the age of the firm (e.g. Davis et al. 1996). Cooley and Quadrini (2001) and Albuquerque and Hopenhayn (2004) show that adding financial frictions to the standard models of firm dynamics can account for these facts.

Our paper contributes to this literature in two ways:

· First, despite the abundance of plausible theoretical mechanisms that can generate realistic firm dynamics, there is very little evidence on the role of financial frictions generating these dynamics.

· Second, models of financial frictions have very different predictions on how firms of different ages and sizes will borrow, and why. For example, the models of Cooley and Quadrini (2001) and Albuquerque and Hopenhayn (2004) predict different relationships between firm size and leverage. The former model implies that smaller, younger and more productive firms have higher leverage, and leverage declines over time as firms increase their equity. Hence, size and leverage are negatively associated conditional on age and productivity. In contrast, Albuquerque and Hopenhayn (2004) implies that larger and more productive firms have larger projects financed with long-term debt. Over time as firms’ equity grow, firms pay down their long-term debt, which relaxes the borrowing constraint on the short-term debt. Therefore, as firms grow, they incur more short-term debt, leading to a positive relation between firm size and leverage based on short-term debt. Both of these models predict a negative relationship between age and leverage since young firms borrow more. Overall, our empirical findings support models that predict heterogeneity in leverage and also imply a positive relationship between size and a leverage and a negative relationship between age and leverage.

Another contribution of our work is to shed light on the difficult mapping from firm size to financial constraints via variables on actual borrowing such as leverage, short-term debt, and liquid assets. The literature has so far produced mixed results on this connection. We argue that in order to identify the link between firm size, leverage and financial constraints, three ingredients are key:

· First, one has to condition on age.

· Second, the dataset has to encompass the full size distribution, covering the range of small firms.

· And third, size should be measured with employment.

We believe, most of the previous findings in the literature reflect differences in the growth and financing policies of firms at different stages of firms’ lifecycles. Firms’ need for internal versus external finance will vary with their lifecycle and firms which use external finance will be more susceptible to credit shocks. In this sense, large firms, which rely more on external finance, might be more negatively impacted during periods of credit crunch. On the other hand, very large firms can also substitute between bank and market debt. Similarly, very small firms might have limited access to credit during both normal times and crisis times. Hence, it is hard to identify the effect of shocks on such firms. Consequently, coverage of both small and large firms is essential to understand the nature of the relationship between financial constraints and leverage. Our finding that short-term leverage ratios are higher in larger private firms but lower in larger public firms supports this line of argument.

Finally, employment is a better measure of size than assets. Most of the prior studies measure size using assets. Typically, small firms are defined to be those that fall into the 25th-30th percentile of sales or assets distributions, which implies assets of less than $1 billion – a very large cut-off for designating small firms. In addition, depending on whether assets are measured at book value or at market value, an asset-based measure of size will fluctuate more (or less) than an employment-based measure of size even though the firm is actually not growing or shrinking.

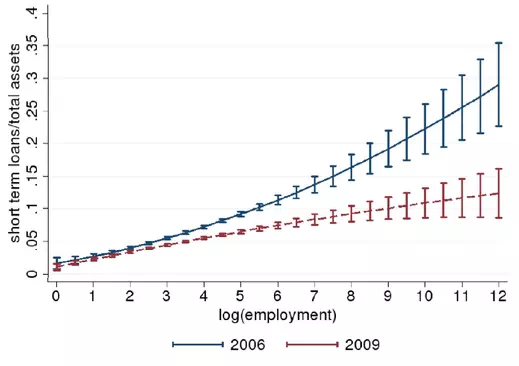

Using the Great Recession as a shock to financial conditions, we show that some firms might be credit-constrained both in normal and crisis times (small private firms), some firms might become more constrained during the crisis times (large private firms), and some firms never appear to be constrained (large public firms). Figure 5 shows that the Great Recession was not a credit-tightening episode for large public firms in the same way it was for private firms. Large private firms decreased leverage in 2009 relative to 2006 since they have to de-lever given tighter financial conditions, but there is no difference in leverage for public firms in 2006 versus 2009.

Figure 4 Short term loans/total assets, 2006 vs 2009

Figure 5 Short term loans/total assets, 2006 vs 2009

What is the role of the decline in demand for credit by firms for these results? We argue that the negative demand shock was an aggregate shock, affecting all firms given their sector. To provide further evidence on de-leveraging, we have run firm-level growth regressions in a difference-in-difference framework with sector*year fixed effects that will absorb the demand shocks. These regressions compare the growth patterns of high- versus low-leverage firms before and after the crisis. The findings suggest that firm leverage and firm growth move together with a potential to create boom-bust cycles in the economy. We show that leverage and firm growth are strongly positively correlated for private firms during normal times, and during the crisis firms with high leverage tend to grow less. This pattern is to be expected if high-leverage firms finance their growth with external debt during normal times and cannot borrow to the same extent during crisis times. In contrast, public firms’ growth is negatively related to their short-term leverage in normal times and in crisis times; a crisis has no effect on the leverage–growth relationship for public firms. This result suggests that public firms are not financially constrained during normal times or during a crisis, but rather slow-growing, large incumbent public firms accumulate more debt.