Raghuram Rajan comes both to praise community and to bury it. This University of Chicago professor and former chief economist for the International Monetary Fund wants his new book to “reintroduce into the debate” the titular and neglected “third pillar” of community alongside the pillars of market and state that dominate modern society. Rajan says he is seeking “the right balance between them so that society prospers.” But he lacks the courage of his convictions. What begins as an incisive critique of how economists and policymakers abandoned community ends as a dismaying illustration of the problem.

The prospect tantalizes: a voice from within some of our most market-focused institutions arguing that “community matters” and so “it is not enough for a country to experience strong economic growth.” The opening chapters of “The Third Pillar” sparkle with concrete illustrations of how vibrant local communities contribute to human flourishing in ways typically overlooked. Rajan describes how ranchers benefit by handling livestock trespass cooperatively. Because the community is more attuned to individual circumstance, he observes, “given any quantity of available resources, it can offer a far-higher level of benefit to the truly needy.”

As a former central banker, Rajan gives special attention to the community’s role in financial markets and goes so far as to defend long-ago prohibitions on usury. Neighbors helping neighbors represents a form of saving, creating a reciprocal obligation to be repaid when the tables inevitably turn. Small, young firms tend to get more and better loans when fewer banks are present, perhaps because less competition means a higher likelihood of retaining a firm’s business as it grows. This leads to a crucial, more generalizable point: “Relationships seem to be stronger when the members of the community have fewer alternatives, for it gives the members confidence that they will stay mutually committed.” The modern market’s greater abundance of choice is not without trade-offs.

These threads dissolve in the hundreds of pages of vaguely sketched economic history that follow. While ably describing how both a growing market and a growing state have eroded the community’s relevance and vitality over time, Rajan gradually redefines the third pillar from “communities whose members live in proximity” to merely democracy or the “voting public.” An intrinsically valuable and varied local institution congeals into a homogeneous tool for ensuring that the market and state behave.

When genuine community does make a return in the book’s section on prescriptions, Rajan sacrifices it willingly. Having shown how the state has weakened community by seizing the role of safety net, he nevertheless wants to go further in that direction. America’s variety of antipoverty programs, “strung together with the help of the state government, the local government, private efforts and charitable funds” (in other words, “community”), are “inadequate,” he says, calling instead for “a basic level of unconditional federal economic support” along with universal health care. On one page, Rajan recommends that “powers should stay at the most decentralized level consistent with their effective use,” but on the next he declares that “when inclusiveness goes up against localism, inclusiveness should always triumph.”

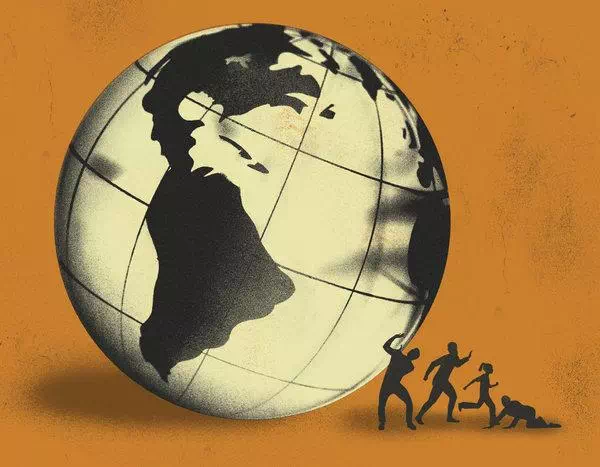

Rajan’s real aim seems to be movement “toward one borderless world,” with stronger communities a perhaps helpful means to that end. “A central concern in this book,” he writes, “is about the passions that are unleashed when an imagined community like the nation fulfills the need for belonging that the neighborhood can no longer meet.” He recalls wistfully the days when “technocrats … did not have to spell out these arguments to the wider public.” Sure, “the elite did not engage” in any debate “as they abandoned the integrated community,” but he finds it “hard to fault their choice.” After all, “the meritocratic markets now demanded it.”