One way or another, President Trump is going to drag the Fed into his trade wars.

Tonight Trump announced via Twitter that imports from Mexico would face a 5% beginning June 10. The tariff could rise as high as 25% unless Mexico acts to stem the flow of refugees from Central America. It’s not clear that the legal authority exists to take such action, but, you know, details, details. And the White House is trying to argue that these tariff threats are separate from the USMCA trade deal that is currently a legislative priority. I guess this is like telling your wife that your mistress doesn’t have anything to do with your marriage.

You really can’t make this stuff up anymore.

A couple of points jump to mind here. First, this obviously threatens to disrupt North American supply chains. The auto industry in particular is likely to suffer as the industry accounts for a large share of the imports from Mexico. This can’t come at a much worse time given the US auto sales are on the downhill side of the post-Recession recovery.

Second, it doesn’t bode well for a trade deal with China. Chinese leaders will see what happens when you enter into a good faith deal with the U.S with this administration. It is reasonable to think China’s play here is to stretch this out until after 2020 elections and hope they have someone more reasonable to deal with.

Third, this weaponized uncertainty isn’t good for U.S. business confidence. Business leaders are already nervous about the sustainability of the expansion given it will soon be a record-breaker. The trade wars with China had them on further edge. An expansion of that war Mexico could undermine confidence further and discourage investment. We don’t know what straw will break the camel’s back here, but Trump is looking like he wants to try to find out.

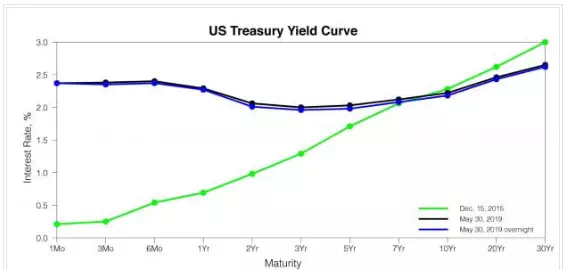

Unsurprisingly, stock future fell while U.S. treasuries rallied, the latter only intensifying the inversion in the belly of the yield curve:

The story here is that market participants anticipate the Fed will need to cut rates to maintain the expansion. The Fed has so far resisted this story, but the odds favor them moving in this direction. The simple fact is that the Fed reacts systematically to a changing forecast. Financial markets are signaling the the growth forecast will worsen enough, or that the risks to the growth forecast will become sufficiently one-sided, that the Fed will have to act. The Fed isn’t there yet, but they will not be able to resist forever.

Bottom Line: Trump will get the Fed to back his trade wars, but only threatening to damage the U.S. economy first.