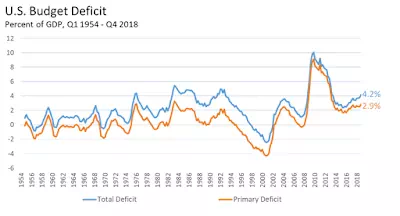

The U.S. federal budget deficit for 2018 came in just shy of $800 billion, or about 4% of the gross domestic product (the primary deficit, which excludes the interest expense of the debt, was about 3% of GDP).

As the figure above shows, the present level of deficit spending (as a ratio of GDP) is not too far off from where has been in the 1970s and 1980s. It’s also not too far off from where it was in the early 2000s (although, the peaks back then were associated with recessions).

Of course, the question people are asking is whether deficits of this magnitude can be sustained into the foreseeable future without economic consequences (like higher inflation). In this post, I suggest that the answer to this question is yes, but just barely. If I am correct, then any new government expenditure program will have to come at the expense of some other program, or be funded through higher taxes. Let me explain my reasoning.

The Arithmetic of Government Spending and Finance

I begin with some basic arithmetic (I describe here where theory comes in). Let G denote government expenditures and let T denote government tax revenue. Then the primary deficit is defined as S = G – T ( if S < 0, then we have a primary surplus ). The absolute magnitudes involved have little meaning–it turns out to be more useful to measure a growing deficit relative to the size of a growing economy. Let Y denote the gross domestic product (the total income generated in the economy). The deficit-to-GDP ratio is then given by (S/Y). In what follows, I will assume that this ratio is expected to remain constant over the indefinite future (this is what a “sustainable” budget deficit means.)

Let D denote the outstanding stock of government “debt.” For countries that issue debt representing claims to their own currency and permit their currency to float in foreign exchange markets, attaching the label “debt” to these objects–like U.S. Treasury securities–is somewhat misleading. The better analog in this case is equity. Companies that finance acquisitions or expenditure through equity do not have to worry about bankruptcy. They may have to worry about diluting the value of existing shareholders if they over-issue equity, or use it to finance negative NPV projects. The same is true of the U.S. federal government (but not state or local governments). The risk of over-issuing treasury debt is not default–it is share dilution (i.e., inflation).

Let R denote the gross yield on debt (so that R – 1 is the net interest rate). If we interpret D as currency, then R = 1 (currency has a zero net yield). If we interpret D as U.S. Treasury debt, then R = 1.025 (UST debt has an average net yield of around 2.5%). Note that in some jurisdictions today, government debt has a negative yield (so, R < 1 ) — that is, government “debt” is in this case an income-generating asset!

Alright, back to the arithmetic. Let D’ denote the stock of debt inherited from the previous period that is due interest today. The interest expense of this debt is given by (R – 1)D’ (the interest expense of currency is zero). The primary deficit plus interest expense must be financed with new debt D – D’, where D represents the stock of debt today and D’ represents the stock of debt yesterday. Our simple arithmetic tells us that the following must be true:

[1] S + (R – 1)D’ = D – D’

Let me rewrite [1] as:

[2] S = D – RD’

Now, let’s divide through by Y in [2] to get:

[3] (S/Y) = (D/Y) – R(D’/Y)

We’re almost there. Notice that (D’/Y) = (D’/Y’)(Y’/Y). [I want to say that this is just high school math…except that my son came to me the other night with a homework question I could not answer. If you’re not good at math, I understand your pain. But if you need some help, don’t be afraid to ask someone. Like my son, for example.]

Define n = (Y/Y’), the (gross) rate at which the nominal GDP grows over time. In my calculations below, I’m going to assume n = 1.05, that is 5% growth. Implicitly, I’m assuming 2-3% real growth and 2-3% inflation, but I don’t think what I have to say below depends on what is driving NGDP growth. In any case, let’s combine (D’/Y) = (D’/Y’)(Y’/Y) and n = (Y/Y’) with [3] to form:

[4] (S/Y) = (D/Y) – (R/n)(D’/Y’)

One last step: assume that the debt-to-GDP ratio remains constant over time; i.e., (D’/Y’) = (D/Y). Again, I impose this condition to characterize what is “sustainable.” Combining this stationarity condition with [4] yields:

[*] (S/Y) = [1 – R/n ](D/Y)

Condition [*] says that the deficit-to-GDP ratio is proportional to the the debt-to-GDP ratio, with the factor of proportionality given by [1 – R/n ]. This latter object is positive if R < n and negative if R > n.

The Mainstream View

There is no such thing as “the” mainstream view, of course. But I think it’s fair to say that in thinking about the sustainability of government budget deficits, many economists implicitly assume that R > n. In this case, condition [*] says that if the outstanding stock of government debt is positive (D > 0), then sustainable deficits are impossible. Indeed, what is needed is a sustainable primary budget surplus to service the interest expense of the debt.

The condition R > n is a perfectly reasonable assumption for any entity that does not control or influence the money supply: state and local governments, emerging economies that issue dollar-denominated debt, EMU countries that issue debt in euros, federal governments that abide by the gold standard or delegate control of the money supply to an independent central bank with a preference for tight monetary policy.

The only exception to this that a mainstream economist might make is for the case of “debt” in the form of currency. The seigniorage revenue generated by currency (zero-interest debt), however, is typically considered to be small potatoes. Consider the United States, for example. Let’s interpret Das currency. Currency in circulation is presently around $1.7 trillion, almost 10% of GDP. So let’s set (D/Y) = 0.10, R = 1, and n = 1.05 in equation [*]. If I’ve done my math correctly, I get (S/Y) = 0.0025, or (1/4)% of GDP. That’s about $100 billion. This may not sound like “small potatoes” to you and me, but it is for a government whose expenditures in 2018 totaled about $4 trillion.

The New and Modern Monetarist View

I think of “monetarists” as those who view money and banking as critical factors in determining macroeconomic activity. I’m thinking, for example, of people like Friedman, Tobin, Wallace, Williamson and Wright (old and new monetarists) on the mainstream side and, for example, Godley, Minksy, Wray, Fullwiler on the MMT (and other heterodox) side. A common ground shared by new/modern monetarists is the view of treasury debt as a form of money; i.e., the difference between (say) U.S. Treasury debt and Federal Reserve money is more of degree than in kind. Consider, for example, the following two objects:

Can you spot the difference? The first one was issued by the U.S. Treasury and the second one by the Federal Reserve (the promised redemption for silver has long since been suspended). The Fed is said to “monetize the debt” when it replaces the top bill with the bottom bill. Is it any wonder why the BoJ cannot create inflation by swapping zero-interest BoJ reserves for zero-interest JGBs? (In case you’re interested, see my piece here.)

In any case, rightly or wrongly, U.S. government policy presently renders the treasury bill illiquid (in the sense that it cannot easily be used to make payments). Of course, while the treasury bill no longer exists in physical form, every U.S. person can acquire the electronic version of (interest-bearing) T-bills at www.treasurydirect.gov. Just don’t expect to be able to pay your rent or groceries with your treasury accounts any time soon. (Though, as I have argued elsewhere, it would be a simple matter to integrate treasury direct accounts with a real-time gross settlement payment system.)

But even if treasury securities cannot be used to make everyday payments, they are still liquid in the sense of being readily convertible into money on secondary markets (and maybe one day, on a Fed standing repo facility, as Jane Ihrig and I suggest here and here). USTs are used widely as collateral in credit derivative and repo markets — they constitute a form of wholesale money. Because they are safe and liquid securities, they can trade at a premium. A high price means a low yield and, in particular, R < n is a distinct possibility for these types of securities.

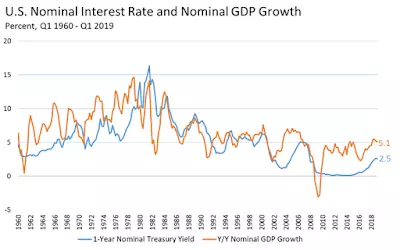

In fact, R < n seems to be the typical case for the United States.

The only exception in this sample is in the early 1980s — the consequence of Volcker’s attempt to reign in inflation.

But if this is the case, then the mainstream view has long neglected a source of seigniorage revenue beyond that generated by currency. Low-yielding debt can also serve as a revenue device, as made clear by condition [*] above. How much is this added seigniorage revenue worth to the U.S. government?

Let’s do the arithmetic. For the United States, the (gross) debt-to-GDP ratio is now about 105%, so let’s set (D/Y) = 1.0. Let’s be optimistic here and assume that the average yield on USTs going forward will average around 2%, so R = 1.02. As before, assume NGDP growth of 5%, or n = 1.05. Condition [*] then yields (S/Y) = 0.03, or 3% of GDP. That’s about $600 billion.

$600 billion is considerably more than $100 billion, but it’s still small relative to an expenditure of $4 trillion. And, indeed, since the budget deficit is presently running at around $800 billion, there seems little scope to increase it without inducing inflationary pressure. (Note: by “increase it” I mean increase it relative to GDP. In the examples above, the debt and deficit all grow with GDP at 5% per year).

Conclusion

What does this mean for fiscal policy going forward? The main conclusion is that the present rate of deficit spending and high level of debt-to-GDP is not something to be alarmed about (especially with inflation running below 2%). The national debt can, will, and probably should continue to grow indefinitely along with the economy. What matters more is how expenditures are directed and how taxes are collected. Of course, this should be done with an eye to keeping long-term inflation in check.

What deserves our immediate attention, in my view, is a re-examination of the mechanisms through which government spending (when, where and how much) is determined. This is not the place to get into details, but suffice it to say that one should hope that our elected representatives have a capacity to reason effectively, have a broad understanding of history, are willing to listen, and do not view humility and compromise as four-letter words or signs of personal weakness. If we don’t have this, then we have much deeper problems to deal with than the national debt or deficits.

Once the spending priorities have been established, the question of finance needs to be addressed. If the level of spending is less than 2% of GDP, then explicit taxes can be set to zero–seigniorage revenue should suffice. However, if we’re talking 20% of GDP then tax revenue is necessary (at least, if the desired inflation target is to remain at 2%). If the tax system is inefficient and cannot be changed, this may mean cutting back on desired programs. Ideally, of course, the tax system could be redesigned to minimize inefficiencies and distortions. But tax considerations are likely always to remain in some form and, because this is the case, they should be taken into consideration when evaluating the net social payoff to any new expenditure program.

Comments are closed.