It is a mechanics which involve the compound interest factors to express cash flows (payments) occurring at different times to a single equivalent payment. Let’s understand interest rates and its types which would be helpful in understanding compound interest factors.

Interest rate and types of interest rate

Interest rate is said to be the earning power of money. Because of interest rate and time factor, the numerical value of money (not purchasing power) multiplies over a period of time.

Interest is the cost of using capital as well as the reward of parting with one’s liquidity (saved money). We are acquainted with two types of interest rates so far, i.e., simple interest rate1 and compound interest rate.

Apart from these two interest rates, some other interest rates which are used in economic evaluation of projects are: nominal interest rate, effective interest rate, and continuous effective interest rate. When we are asked with interest rate, it is generally understood that these interest rates are charged annually.

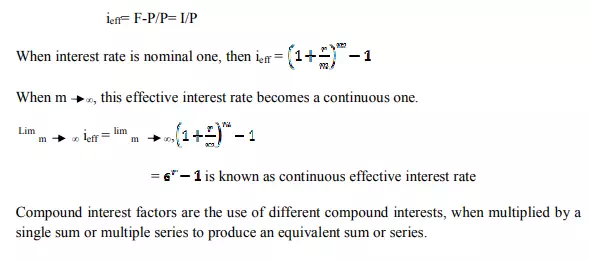

But sometimes, interest rates are charged periodically, and then it becomes a case of nominal interest rate. Nominal interest rate is an annual interest rate which is a product of interest rate per period and number of periods in a year. Effective interest rate (ieff) is the ratio of interest to principal amount. It is used to have comparison between investments.

Comments are closed.