Break-even analysis is a very important aspect of business plan. It helps the business in determining the cost structure and the amount of sales to be done to earn profits.

It is usually included as a part of business plan to observe the profits and is enormously useful in pricing and controlling cost.

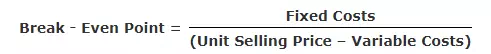

Using the above formula, the business can determine how many units it needs to produce to reach break-even.

When a firm attains break even, the cost incurred gets covered. Beyond this point, every additional unit which would be sold would result in increasing profit. The increase in profit would be by the amount of unit contribution margin.

Unit contribution Margin =

Sales Price – Variable Costs

Let’s have a look at the following key terms −

· Fixed costs − Costs that do not vary with output

· Variable costs − Costs that vary with the quantity produced or sold.

· Total cost − Fixed costs plus variable costs at level of output.

· Profit − The difference between total revenue and total costs, when revenues are higher.

· Loss − The difference between total revenue and total cost, when cost is higher than the revenue.

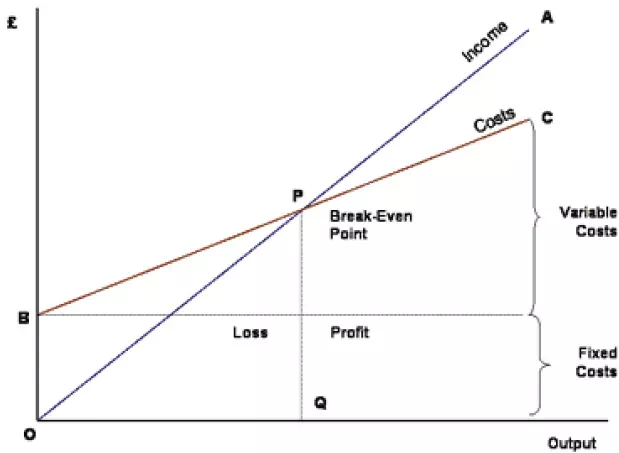

Breakeven chart

The Break-even analysis chart is a graphical representation of costs at various levels of activity.

With this, business managers are able to ascertain the period when there is neither profit nor loss made for the organization. This is commonly known as “Break-even Point”.

In the graph above, the line OA represents the variation of income at various levels of production activity.

OB represents the total fixed costs in the business. As output increases, variable costs are incurred, which means fixed + variable cost also increase. At low levels of output, costs are greater than income.

At the point of intersection “P” (Break even Point) , costs are exactly equal to income, and hence neither profit nor loss is made.