Monopolistic competition is a form of market structure in which a large number of independent firms are supplying products that are slightly differentiated from the point of view of buyers. Thus, the products of the competing firms are close but not perfect substitutes because buyers do not regard them as identical. This situation arises when the same commodity is being sold under different brand names, each brand being slightly different from the others.

For example − Lux, Liril, Dove, etc.

Each firm is therefore the sole producer of a particular brand or “product”. It is monopolist as far as a particular brand is concerned. However, since the various brands are close substitutes, a large number of “monopoly” producers of these brands are involved in a keen competition with one another. This type of market structure, where there is competition among a large number of “monopolists” is called monopolistic competition.

In addition to product differentiation, the other three basic characteristics of monopolistic competition are −

· There are large number of independent sellers and buyers in the market.

· The relative market shares of all sellers are insignificant and more or less equal. That is, seller-concentration in the market is almost non-existent.

· There are neither any legal nor any economic barriers against the entry of new firms into the market. New firms are free to enter the market and existing firms are free to leave the market.

· In other words, product differentiation is the only characteristic that distinguishes monopolistic competition from perfect competition.

Monopoly

Monopoly is said to exist when one firm is the sole producer or seller of a product which has no close substitutes. According to this definition, there must be a single producer or seller of a product. If there are many producers producing a product, either perfect competition or monopolistic competition will prevail depending upon whether the product is homogeneous or differentiated.

On the other hand, when there are few producers, oligopoly is said to exist. A second condition which is essential for a firm to be called monopolist is that no close substitutes for the product of that firm should be available.

From above it follows that for the monopoly to exist, following things are essential −

· One and only one firm produces and sells a particular commodity or a service.

· There are no rivals or direct competitors of the firm.

· No other seller can enter the market for whatever reasons legal, technical, or economic.

· Monopolist is a price maker. He tries to take the best of whatever demand and cost conditions exist without the fear of new firms entering to compete away his profits.

The concept of market power applies to an individual enterprise or to a group of enterprises acting collectively. For the individual firm, it expresses the extent to which the firm has discretion over the price that it charges. The baseline of zero market power is set by the individual firm that produces and sells a homogeneous product alongside many other similar firms that all sell the same product.

Since all of the firms sell the identical product, the individual sellers are not distinctive. Buyers care solely about finding the seller with the lowest price.

In this context of “perfect competition”, all firms sell at an identical price that is equal to their marginal costs and no individual firm possess any market power. If any firm were to raise its price slightly above the market-determined price, it would lose all of its customers and if a firm were to reduce its price slightly below the market price, it would be swamped with customers who switch from the other firms.

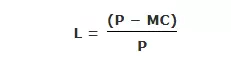

Accordingly, the standard definition for market power is to define it as the divergence between price and marginal cost, expressed relative to price. In Mathematical terms we may define it as

Oligopoly

In an oligopolistic market there are small number of firms so that sellers are conscious of their interdependence. The competition is not perfect, yet the rivalry among firms is high. Given that there are large number of possible reactions of competitors, the behavior of firms may assume various forms. Thus there are various models of oligopolistic behavior, each based on different reactions patterns of rivals.

Oligopoly is a situation in which only a few firms are competing in the market for a particular commodity. The distinguishing characteristics of oligopoly are such that neither the theory of monopolistic competition nor the theory of monopoly can explain the behavior of an oligopolistic firm.

Two of the main characteristics of Oligopoly are briefly explained below −

· Under oligopoly the number of competing firms being small, each firm controls an important proportion of the total supply. Consequently, the effect of a change in the price or output of one firm upon the sales of its rival firms is noticeable and not insignificant. When any firm takes an action its rivals will in all probability react to it. The behavior of oligopolistic firms is interdependent and not independent or atomistic as is the case under perfect or monopolistic competition.

· Under oligopoly new entry is difficult. It is neither free nor barred. Hence the condition of entry becomes an important factor determining the price or output decisions of oligopolistic firms and preventing or limiting entry of an important objective.

For Example − Aircraft manufacturing, in some countries: wireless communication, media, and banking.