Transfer Pricing relates to international transactions performed between related parties and covers all sorts of transactions.

The most common being distributorship, R&D, marketing, manufacturing, loans, management fees, and IP licensing.

All intercompany transactions must be regulated in accordance with applicable law and comply with the “arm’s length” principle which requires holding an updated transfer pricing study and an intercompany agreement based upon the study.

Some corporations perform their intercompany transactions based upon previously issued studies or an ill advice they have received, to work at a “cost plus X%”. This is not sufficient, such a decision has to be supported in terms of methodology and the amount of overhead by a proper transfer pricing study and it has to be updated each financial year.

Dual Pricing

In simple words, different prices offered for the same product in different markets is dual pricing. Different prices for same product are basically known as dual pricing. The objective of dual pricing is to enter different markets or a new market with one product offering lower prices in foreign county.

There are industry specific laws or norms which are needed to be followed for dual pricing. Dual pricing strategy does not involve arbitrage. It is quite commonly followed in developing countries where local citizens are offered the same products at a lower price for which foreigners are paid more.

Airline Industry could be considered as a prime example of Dual Pricing. Companies offer lower prices if tickets are booked well in advance. The demand of this category of customers is elastic and varies inversely with price.

As the time passes the flight fares start increasing to get high prices from the customers whose demands are inelastic. This is how companies charge different fare for the same flight tickets. The differentiating factor here is the time of booking and not nationality.

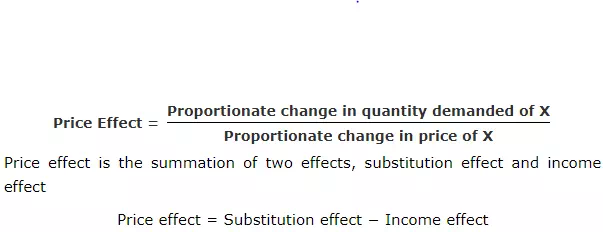

Price Effect

Price effect is the change in demand in accordance to the change in price, other things remaining constant. Other things include − Taste and preference of the consumer, income of the consumer, price of other goods which are assumed to be constant. Following is the formula for price effect −

Substitution Effect

In this effect the consumer is compelled to choose a product that is less expensive so that his satisfaction is maximized, as the normal income of the consumer is fixed. It can be explained with the below examples −

· Consumers will buy less expensive foods such as vegetables over meat.

· Consumers could buy less amount of meat to keep expenses in control.

Income Effect

Change in demand of goods based on the change in consumer’s discretionary income. Income effect comprises of two types of commodities or products −

Normal goods − If there is a price fall, demand increases as real income increases and vice versa.

Inferior goods − In case of inferior goods, demand increases due to an increase in the real income.