Capital Budgeting is the process by which the firm decides which long-term investments to make. Capital Budgeting projects, i.e., potential long-term investments, are expected to generate cash flows over several years.

Capital Budgeting also explains the decisions in which all the incomes and expenditures are covered. These decisions involve all inflows and outflows of funds of an undertaking for a particular period of time.

Capital Budgeting techniques under certainty can be divided into the following two groups −

Non Discounted Cash Flow

- Pay Back Period

- Accounting Rate of Return (ARR)

Discounted Cash Flow

- Net Present Value (NPV)

- Profitability Index (PI)

- Internal Rate of Return (IRR)

The payback period (PBP) is the traditional method of capital budgeting. It is the simplest and perhaps the most widely used quantitative method for appraising capital expenditure decision; i.e. it is the number of years required to recover the original cash outlay invested in a project.

Non-Discounted Cash Flow

Non-discounted cash flow techniques are also known as traditional techniques.

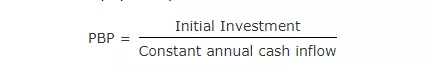

Pay Back Period

Payback period is one of the traditional methods of budgeting. It is widely used as quantitative method and is the simplest method in capital expenditure decision. Payback period helps in analyzing the number of years required to recover the original cash outlay invested in a particular project. The formula widely used to calculate payback period is −

Advantages of Using PBP

PBP is a cost effective and easy to calculate method. It is simple to use and does not require much of the time for calculation. It is more helpful for short term earnings.

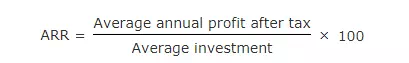

Accounting Rate of Return (ARR)

The ARR is the ratio after tax profit divided by the average investment. ARR is also known as return on investment method (ROI). Following formula is usually used to calculate ARR –

Advantages of Using ARR

ARR is simple to use and as it is based on accounting information, it is easily available. ARR is usually used as a performance evaluation measure and not as a decision making tool as it does not use cash flow information.

Comments are closed.