Comparisons of assets or investment projects are necessary in order to select the best among the alternatives, i.e., to accept one and reject others. When these alternatives are mutually exclusive in nature, comparisons need to be taken into account a particular point of time, i.e., at current or base period as the reference year. Moreover, as the value of any currency keeps on changing over time, comparisons cannot be made across time unless the value of the projects is transferred into a particular time. Let’s take an example: An invested amount of INR 10, 00000 in the year 2014 cannot be compared with 10, 00000 in the year 2011 as both the investment occurred in two different times. These two amounts need to be transferred to the same time for comparison purpose.

What is present worth method?

In present worth method, cash flows of each of the projects occurring in different time are converted to ‘zero time’ (base period), by the help of rate of interest and time factor, which is known as ‘discount rate’. The best alternative project is selected by comparing the present worth amounts of alternatives. Two deciding factors govern in choosing alternatives, viz. minimisation of cost (use of least present worth) and maximisation of profit (maximum present value).

For present worth comparison method, the following assumptions2 need to be taken. Viz.,

a) All cash flows (inflows as well as out flows should be known

b) Time and rate of interest is to be given

c) Constant time value of money

d) Before tax cash flows are to be taken for comparison

e) No intangible factors are to be taken

f) Comparisons should not include considerations of the availability of funds to implement projects or engineering alternatives

Basis of cash flows and calculation of Present worth method

Present worth calculation depend on the nature of cash flows, i.e., whether the cash flows are cost-dominated cash flow stream or revenue-dominated cash flows stream. If majority of cash flows from a project are inflows, then the said cash flow stream is known to be revenuedominated and if majority of cash flows are costs, then cash flow stream is known to be costdominated cash flow. In case of revenue –dominated cash flows, all the inflows take a positive sign and all the out flows take a negative sign. But the reverse happens in case of cost- dominated cash flow stream.

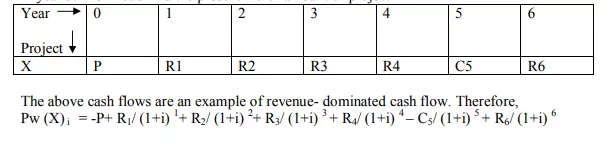

Let’s take that the cash flows of X project are given, P is the initial investment, R1, R2, R3, R4, R6 are the cash inflows for respective years and C5 is the additional investment amount in year 5. Now let’s find the present worth amount of project X

Applications of Present worth Comparison Method

Case: 1 Comparison of assets/projects that have equal lives (Co-terminated assets) If the projects are having equal lives, the best alternative can be chosen by the help of Present worth method. Let’s take there are two alternative projects X and Y and both can continue for 4 years having different cash flows. In this case equal payment series present worth factor (P/A, i, n) can be applied. If Pw(X)> Pw (Y), then X project should be preferred.

Case: 2 Comparison of assets/projects that have unequal lives In case of projects having unequal lives, two techniques can be applied, i.e., Common multiple method and a definite Study- period method. In case of common-multiple method, LCM of unequal lives of the projects are taken and it is tried to find how many times a particular project can repeat (replace) itself. The number o f times a particular project can replace itself is calculated by the ratio of LCM and the individual life of projects. That is why this method is also known as Repeated project method. After finding out the repetition times of projects, then only present worth method can be applied. Whereas in case of a Study period method, a definite period of analysis is taken into account irrespective of the individual longevity of the alternative projects. Therefore, in a study period method, projects always have salvage value.

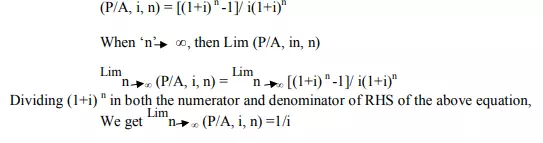

Case: 3 Comparison of assets/projects that have infinite lives Generally we doubt on the infiniteness longevity of project, but this infinite lives is only meant for long-lived assets like dams, fly-overs, tunnels, railway tracks etc. which can continue to render service beyond generations (that means here lives of projects (n) tend to infinite). For these examples Capitalised cost is calculated for comparisons of alternatives. According to Riggs, Bedworth and Randhawa (2004:90), Capitalised cost is “the sum of the first cost and the present worth of (mine: annual) disbursements assumed to last forever…” In capitalised cost we try to reduce each of the cash flows, initial cost as well as other cash flows to zero time. Now capitalised cost can be derived from equal payment series present worth factor.

Comments are closed.