· In a mixed economy, Government plays an important role.

· On certain things, the government has an exclusive right, such as national defence, roads, government administration, etc. (these are known as public goods).

· Government’s allocation function relates to the provision of public goods and services by agencies of the government.

· Through its tax and expenditure policy, government attempts to bring about a distribution of personal income of households in a manner that is considered just and fair. It taxes the rich and designs schemes which benefits the poor.

Annual Financial Statement

· According to the Article 112 of the Indian Constitution, the Government at the centre needs to present annual financial statement before the Parliament. It is a statement of estimated receipts and expenditures of the Government of India in respect of each financial year, which runs from 1 April to 31 March.

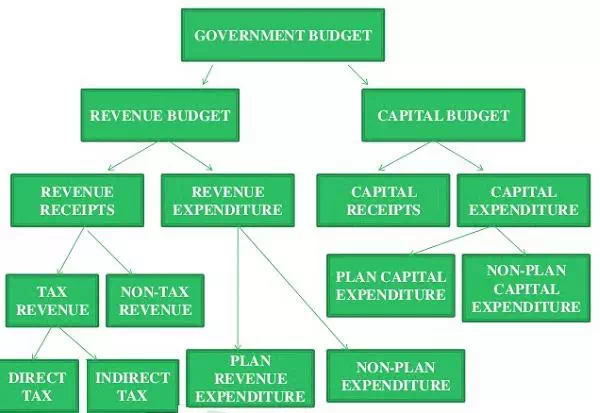

· The Annual Financial Statement is also the main Budget document and is commonly referred to as the Budget Statement. The different types of budgets included in this are as follows −

- Revenue Budget

- Capital Budget

Revenue Budget

· The Revenue Budget illustrates the −

o The Revenue (current) receipts (of the government) and

o The Revenue expenditure (that can be met from these receipts).

Revenue Receipts

· Revenue receipts are receipts of the government which are non-redeemable, i.e., they cannot be reclaimed from the government.

· Revenue receipts are categorized as −

o Tax Revenue.

o Non-tax Revenues.

· Tax revenues consist of the proceeds of the taxes and other duties levied by the central government.

· Tax revenues are further classified into direct taxes (levied directly from the individuals as income tax) and indirect taxes (levied on goods and products within the country).

· Corporation tax contributes the largest share in revenue receipts, followed by income tax.

· Non-tax revenue of the central government largely comprises of −

o Interest receipts on account of loans by the central government.

o Dividends and profits on investments made by the government.

o Fees and other receipts for services rendered by the government.

o Cash grants-in-aid from foreign countries and international organizations.

Revenue Expenditure

· On the other hand, Revenue Expenditure largely includes −

o The expenses incurred for the normal functioning of the government departments and various services.

o Interest payments on debt incurred by the government.

o Grants those are given to the state governments and other parties.

· Budget documents classify total expenditure into plan and non-plan expenditure.

· The plan revenue expenditure includes the central Plans (the Five-Year Plans) and central assistance for State and Union Territory plans.

· Non-plan expenditure includes interest payments, defence services, subsidies, salaries, and pensions.

· Subsidies are important policy instruments, destined to promote welfare in the society.

Capital Budget

· The Capital Budget is an account of the assets as well as liabilities of the central government; it takes into consideration changes in capital.

· The capital account is further categorized as follows −

- Capital Receipts

- Capital Expenditure (of the government).

Capital Receipts

· Capital Receipts include all those receipts of the government, which create liability or reduce financial assets.

· Main items of capital account are loans raised by the government from −

o The public, which is known as market borrowings.

o From the Reserve Bank and commercial banks.

o Other financial institutions through the sale of treasury bills.

o Loans received from the foreign governments and the international organizations.

o Recoveries of the loans granted by the central government.

· Some other items of capital account are −

o Small savings – such as Post-Office Savings Accounts, National Savings Certificates, etc.)

o Provident funds and net receipts obtained from the sale of shares in Public Sector Undertakings (PSUs.

Capital Expenditure

· Capital Expenditure includes the expenditures of the government, which result in the creation of physical or financial assets or reduction in financial liabilities.

· Examples of capital expenditure are as follows −

o Acquisition of land, building, machinery, equipment, investment in shares, and

o Loans and advances by the central government to the governments of state and union territory, PSUs and other parties.

Budget Deficit

· When a government spends more than it receives by the way of revenue, it is known as the budget deficit.

· The difference between revenue expenditure and revenue receipts is known as the revenue deficit.

· The difference between the government’s total expenditure and its total receipts excluding borrowing is known as the fiscal deficit.

· The growth of revenue deficit as a percentage of fiscal deficit points to a deterioration in the quality of government expenditure involving lower capital formation.

· Government deficit can be reduced by an increase in taxes or/and reduction in expenditure.

· Public debt is burdensome if it reduces the future growth in terms of output.

Comments are closed.